Leaving a Legacy

Sam and Beverly Mathis Discover the Value of Estate Planning and the Benefits of the Charitable IRA Rollover

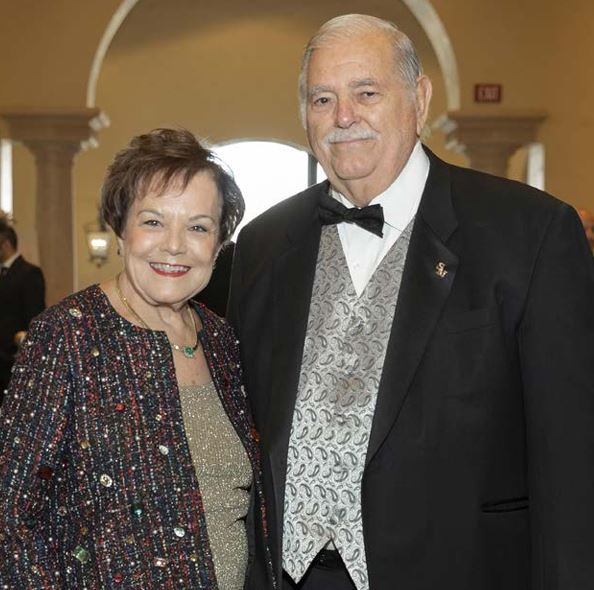

Sam and Beverly Mathis

“Through those conversations, we not only restructured and improved our trust, we also learned how we could save money in taxes through a Charitable IRA Rollover."

For most people, given the choice between paying more taxes or supporting charitable causes in the community, the decision is an easy one. However, financial and estate planning can both be complex matters, so the right options are not always clear.

Such was the case for Sam and Beverly Mathis, long-time residents of Downey and loyal supporters of PIH Health Downey Hospital. They were delighted to learn about a complimentary service available through PIH Health Foundation from Thompson & Associates that could make the complex easy to understand, and help them create the perfect balance between their goals for their own financial peace of mind, providing for their family, and supporting charitable organizations.

Thompson & Associates is nationally recognized as the leader in value-based planning. Their planning sessions with individuals and couples like Sam and Beverly are entirely confidential, unbiased, and pressure free. The Mathis’ were able to create a written plan that they understood and believed in, one that could be taken to their own professional advisors for review and implementation.

“We met several times with Bob Hoffman from Thompson & Associates, who walked us through the entire estate planning process,” said Beverly, who currently serves as the Board Chair for PIH Health Foundation. “Through those conversations, we not only restructured and improved our trust, we also learned how we could save money in taxes through a Charitable IRA Rollover. Instead of giving more to the government, we’d much rather give the money to PIH Health Foundation to support PIH Health Downey Hospital and other causes we care about.”

The Charitable IRA Rollover allows individuals age 70 ½ and older to make direct transfers of up to $100,000 per year from individual retirement accounts to qualified charities without having to count the transfers as income for federal tax purposes.

Ask how you can meet your own personal and financial needs while helping us continue to provide high-quality healthcare to the community we serve.

For more information on complimentary estate planning service through Thompson & Associates, and ways to support PIH Health, email PIHHealthFoundation@PIHHealth.org or call 562.698.0811 Ext. 81520.